“Country roads, take me home,” John Denver’s legendary lines about the charm of America’s heartland, could well be the anthem for Big Retail in 2025.

We are not talking about nostalgia; in fact, it’s all about numbers.

A recent Morgan Stanley report set a stunning figure on this overlooked market. The report stated that rural America offers a $1 trillion opportunity in personal goods consumption, with rural households spending about 95% as much as urban ones.

Interestingly, nearly 45 million Americans live in rural counties, and the Bureau of Labor Statistics’ 2023 Consumer Expenditure Survey shows they account for around one-fifth of national personal goods spending.

Today, this promise of rural America and its potential purchasing power has ignited a race among the country’s retail giants — Amazon, Walmart, Dollar General, Target, and Uber — each announcing investments, expansion of stores, and strengthening delivery capacity to dominate the American heartland.

In this issue of CrossDock, we’ll break down their strategies, analyze who’s best positioned to dominate this battle, and explore what this high-stakes contest means for the future of the retail landscape.

And where better to start than with the retailer that wrote the playbook on conquering small-town America.

Walmart Effect

Walmart’s dominance in rural America is rooted in its founding principle and strategy.

Its founder, legendary Sam Walton, decided to expand Walmart in small towns that the retail giants of the 1960s had written off. His idea of doing this was both simple and revolutionary: rural families had the same desires as their urban counterparts for low prices and a wide range of selection. But what stopped them was the economics of the small-town general store — high prices and limited choice.

He wanted to change this and did so with logistics.

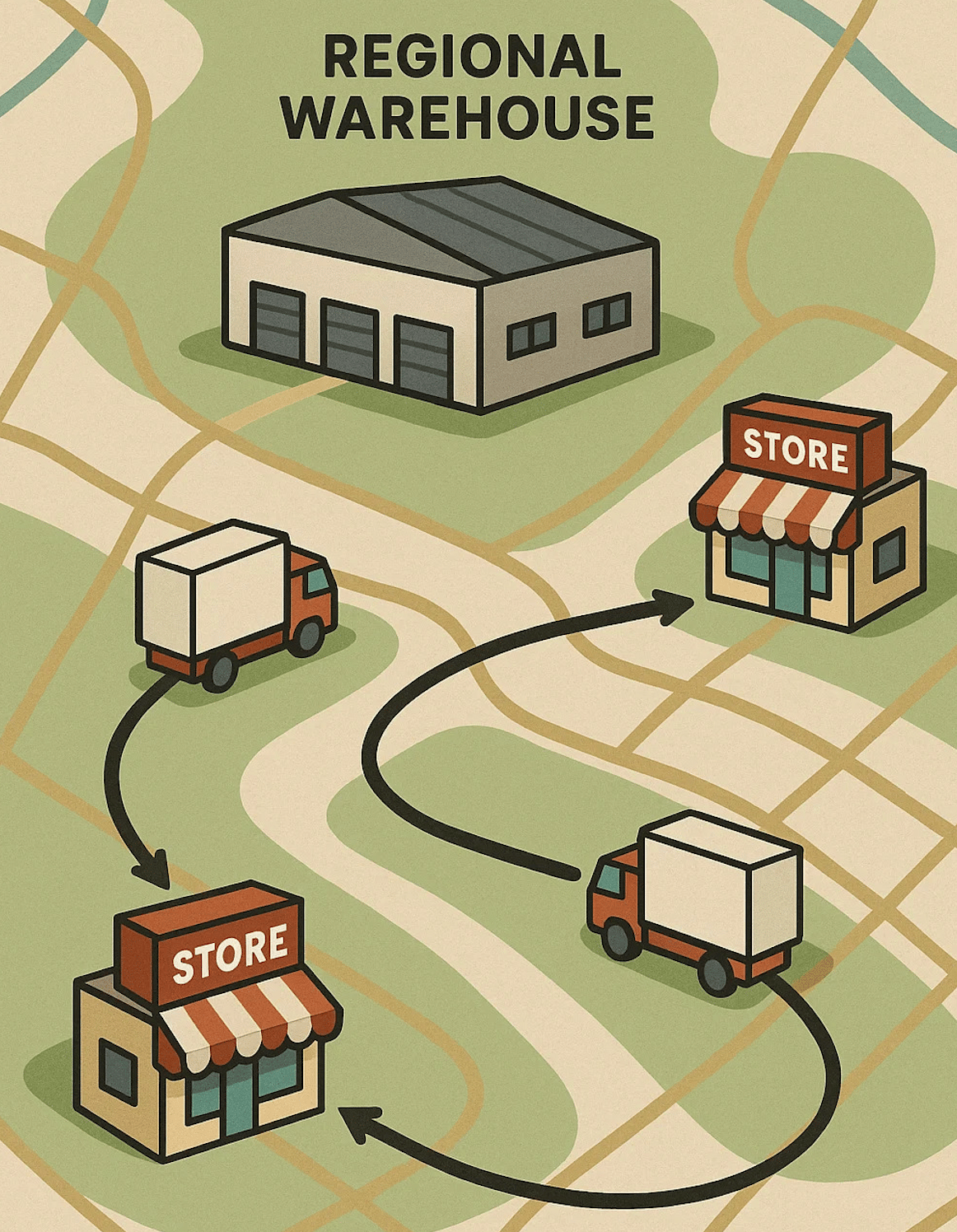

Instead of scattering stores randomly, he first built a regional warehouse, then placed stores in a tight circle, each close enough for a truck to make a round trip in a single day.

By clustering stores around a regional warehouse, Walmart could run trucks more efficiently, deliver shipments more often, and keep far less inventory sitting idle on store shelves. That meant lower freight costs, lower financing costs on inventory, and less spoilage. And every penny shaved off logistics fed straight into its “Everyday Low Prices” strategy, letting Walmart undercut the local general store.

By clustering stores around a regional warehouse, Walmart could run trucks more efficiently

Next came the variety. Walmart often stocked these stores with a wide range of product options that rural shoppers only found in city malls located in faraway cities.

For rural families, these changes by Walmart were transformative: they no longer had to drive to distant city malls for variety and discounts. Walmart delivered both right to their doorstep.

And to further cement its dominance in the late 1980s, Walmart created its Supercenters. These are giant stores that sell everything in one place. You could get your groceries, pick up prescriptions from the pharmacy, and buy clothes or tools all in the same building.

In many small towns, the Supercenter became more than just a store—it was the all-in-one hub for groceries, medicine, clothing, and household goods.

By the mid-1990s, over 60% of Walmart’s stores were located in counties with populations under 50,000, proof of Walmart’s rural dominance.

Cut to the present day, Walmart has about 4,800 stores in the U.S., and over 90% of Americans live within 10 miles of a Walmart store. For many low-income and small-town families, it’s the main place to shop, including those who depend on food assistance programs. In fact, around 38% of Walmart stores are in rural or suburban areas, underscoring how important the chain is in rural America.

Interestingly, it is its brick-and-mortar footprint that is powering Walmart’s e-commerce and ultrafast delivery plans in rural America.

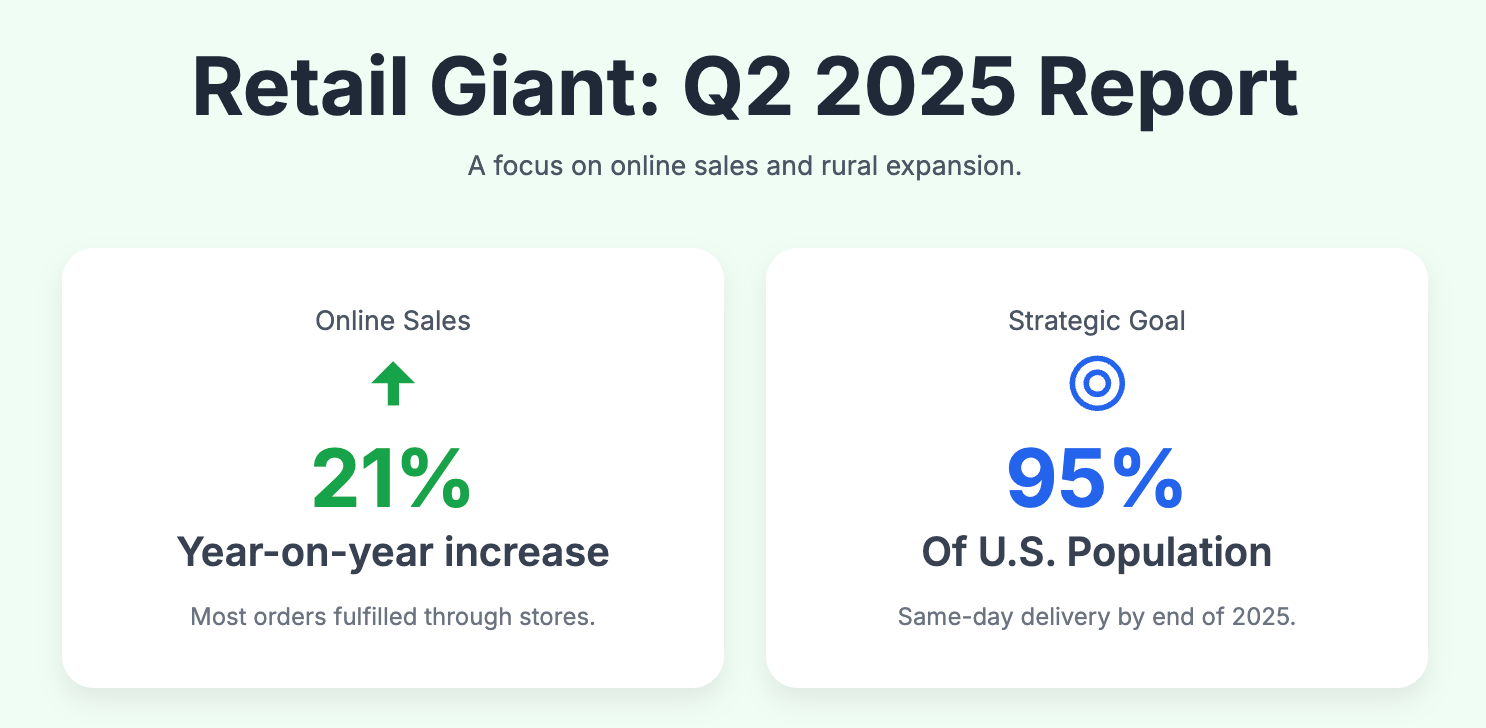

In its latest Q2 2025 earnings report, the retail giant stated that its online sales were up 21% year-on-year, with most orders fulfilled through stores rather than distant warehouses. The company says its goal is to offer same-day delivery to 95% of the U.S. population by the end of 2025. And rural America is central to this push.

For many low-income rural households, the single biggest line item in their budget isn’t clothing or electronics — it’s groceries.

According to the Bureau of Labor Statistics, lower-income families spend up to 30–35% of their income on groceries, compared to around 12–15% for higher-income households. That makes affordable access to groceries absolutely central to rural retail.

And this is where Walmart dominates. Today, it leads the U.S. grocery market with a 24% share, and as of 2024, it controls 37% of the online grocery market — well ahead of Amazon. Add to this its “Everyday Low Prices,” and Walmart is not only the primary grocer for much of rural America, but also the one best positioned to translate food demand into sustainable online delivery models.

But while Walmart built its empire on logistics scale and grocery dominance, another retailer quietly carved out an even deeper presence in rural America, not with big, gigantic buildings, but with tens of thousands of tiny stores.

Strong Dollar

In February 2025, Dollar General opened its 20,000th store in southeastern Texas, a staggering number that is nearly four times Walmart's U.S. store count and nearly 7,000 stores more than even McDonald's!

In fact, Dollar General’s success in rural America is due to its sheer number of stores and the powerful philosophy, summed up by their former CEO David Perdue: "We go where they ain't."

Dollar General's strategy is to avoid direct competition with big-box retailers, especially Walmart. Instead of building large stores in towns with populations over 20,000, it goes deeper into America's retail deserts. These are towns with populations ranging from 1,000 to 10,000, and areas that are often underserved and lack other retail options. By establishing a presence in these communities, Dollar General becomes a lifeline, effectively serving as the default general store due to sheer proximity.

Additionally, it places a strong emphasis on convenience. A Walmart store might offer tens of thousands of items at rock-bottom prices, but it often requires a significant drive and a time-consuming shopping trip. Dollar General, by contrast, provides convenience and affordable prices right in the neighborhood. For a rural resident who would otherwise have to drive 20 or 30 miles for a carton of milk or a tube of toothpaste, the local Dollar General is a quick, five-minute stop.

Another critical aspect that has contributed to Dollar General’s success is its laser focus on its target audience and their needs. Dollar General's target demographic is primarily composed of lower- to middle-income households with annual incomes below $40,000 in rural and small-town areas. For these customers, the store's business model is a perfect fit.

While Walmart's scale allows it to offer lower unit prices on bulk goods, Dollar General smartly focuses on smaller package sizes—a four-pack of toilet paper instead of a family-sized pack, or a pint of milk instead of a gallon. This keeps the absolute price low, allowing shoppers on tight budgets to buy only what they need in the moment.

Let’s now move on to its infrastructure.

To keep costs down and fuel its rapid expansion, the company leases its store locations rather than buying them, which minimizes capital investment. The stores themselves are smaller, typically 7,400 to 9,000 square feet, and feature a limited, curated selection.

That is because Dollar General runs lean, offering only 10,000–11,000 SKUs compared with the nearly 100,000 SKUs in a Walmart. This limited selection is a deliberate choice. This allows the company to focus only on essential items for its customer base, and also does not complicate the supply chain process. For instance, most Dollar General stores do not carry fresh produce or perishables, which have a lower shelf life and thinner margins.

Over the years, these strategies have paid off, and this is reflected in its financial results.

From 1990 to 2020, Dollar General achieved a staggering 30 consecutive years of positive same-store sales growth. In just a decade, from 2010 to 2020, the company’s annual revenue more than doubled, from roughly $13 billion to $27.8 billion. And in 2024, Dollar General’s revenue hit $40.6 billion.

Additionally, it’s worth noting that other dollar stores have not been able to replicate the success of Dollar General.

For example, Family Dollar is struggling to find its footing. Its parent company, Dollar Tree, has announced the closure of over 700 stores in 2024. This move highlights a fundamental difference in strategy. While Dollar General has maintained a clear value proposition and focused on convenience, Family Dollar has grappled with inconsistent product offerings, store maintenance issues, and a confusing pricing strategy, all of which have alienated its core customer.

Dollar General is also quietly building a digital and delivery ecosystem.

The company is rapidly scaling partnerships with delivery giants like DoorDash and Uber Eats, along with its own same-day delivery service, to bring convenience to towns traditionally beyond the reach of one-hour delivery promises.

According to the company, Dollar General now offers same-day delivery through DoorDash at over 17,000 stores, has expanded its generic DG Delivery to nearly 6,000 locations, and expects to reach 16,000 by year-end. The new Uber Eats partnership is also quickly gaining steam, having already launched in 4,000 stores.

The results are already striking. "We saw a 60% year-over-year increase on [DoorDash’s] platform," CEO Todd Vasos said in a recent earnings call. He stated that the company has also signed a deal with Uber Eats to bring 14,000 stores onto that platform by the end of the third quarter.

Even more impressive, Dollar General claims more than 75% of its orders are delivered in an hour or less, a speed that Vasos believes is a significant competitive advantage, especially in hard-to-reach rural areas.

But Dollar General is not alone in chasing the rural last mile. Amazon, the undisputed giant of e-commerce, has also set its sights on small-town America.

Amazon’s Rural Expansion

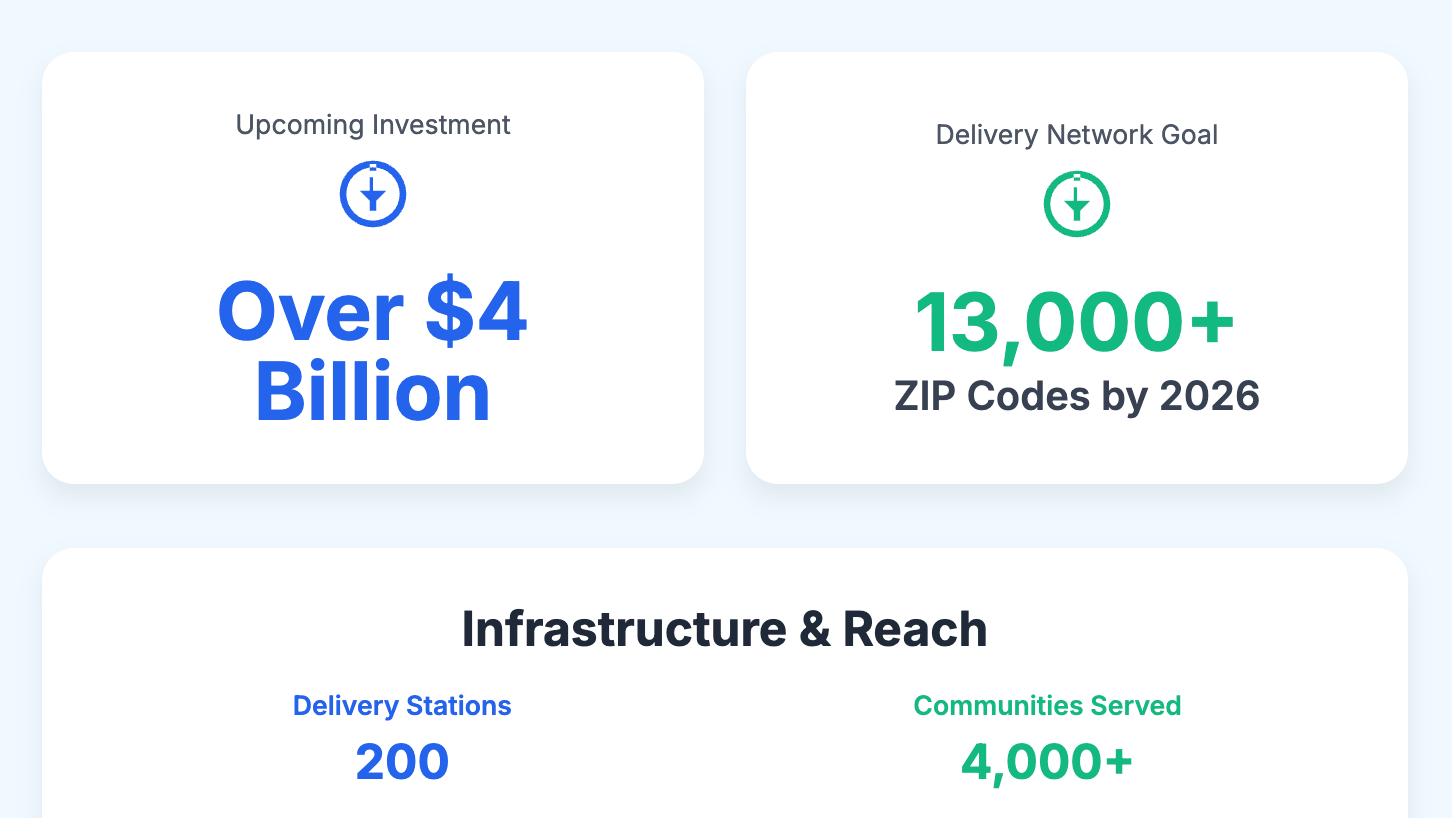

On April 30, 2025, Amazon unveiled a bold plan to invest $4 billion in expanding its delivery network across small towns and rural America. According to the company, the investment will expand its rural network footprint to over 200 delivery stations, aiming to triple the network's size to halve delivery times for rural customers..

“While many logistics providers have backed away from investing in rural customers and communities, we’re doing the opposite,” said Udit Madan, Amazon’s senior vice president of worldwide operations, in a press release.

As part of its plan, Amazon announced in June that it would bring same- or next-day delivery to more than 4,000 smaller cities, towns, and rural communities across the country “for the first time” by the end of 2026. The e-commerce giant plans to extend this delivery across 13,000 ZIP codes in the United States.

Amazon said, “This expansion goes beyond speed — it’s about transforming daily life for rural customers, who typically live farther from brick-and-mortar retailers, have fewer product and brand choices, and face limited delivery options when shopping online.”

But why is Amazon expanding into rural America?

Amazon, for the longest time, had outsourced last-mile delivery in rural areas to UPS. However, earlier this year, UPS announced plans to slash Amazon shipment volume by over 50% by mid‑2026. This also includes rural areas that UPS was delivering to.

Simultaneously, other logistics players like FedEx and the USPS have ramped up surcharges or trimmed rural routes due to rising "cost-to-serve" pressures. For example, FedEx charges up to $15.50 per package for deliveries to remote ZIP codes.

These delivery gaps have created space for Amazon to step in.

With delivery options dwindling, Amazon can use this chance to transform its relationship with rural customers by building its own fulfillment infrastructure and offering competitive speeds that carriers like UPS were withdrawing from.

And there’s one more reason. Amazon’s move into rural America isn’t just about faster shipping — it’s also about challenging Walmart’s decades-old dominance in small-town retail. Amazon's expansion is clearly aimed at meeting Walmart head-on and gaining a market share in a region it has neglected for too long.

While Amazon and Walmart see rural America as a battleground to win, for Target, it's about survival.

Uber Target

Traditionally, Target has been the store that catered to demographics prioritizing style over cost. And hence, the retailer focused on urban markets and stayed away from smaller towns and semi-rural markets.

But with sales falling (for 11 consecutive quarters) and store traffic slipping, the company is now recalibrating. It has announced plans to open more than 300 new stores, while remodeling nearly 2,000 others, many of which are being located in towns where Target previously had no presence.

This expansion is centered on a "stores-as-hubs" strategy, where these new locations will not only serve as shopping destinations but also as critical nodes for same-day fulfillment services. This approach allows the company to leverage its physical footprint to support online orders, offering services like in-store pickup and delivery.

But Target has a long way to go in a geography that Walmart already rules. For example, in rural states like Wyoming and Montana, Walmart has 13 and 22 stores, while Target has only 2 and 4, respectively.

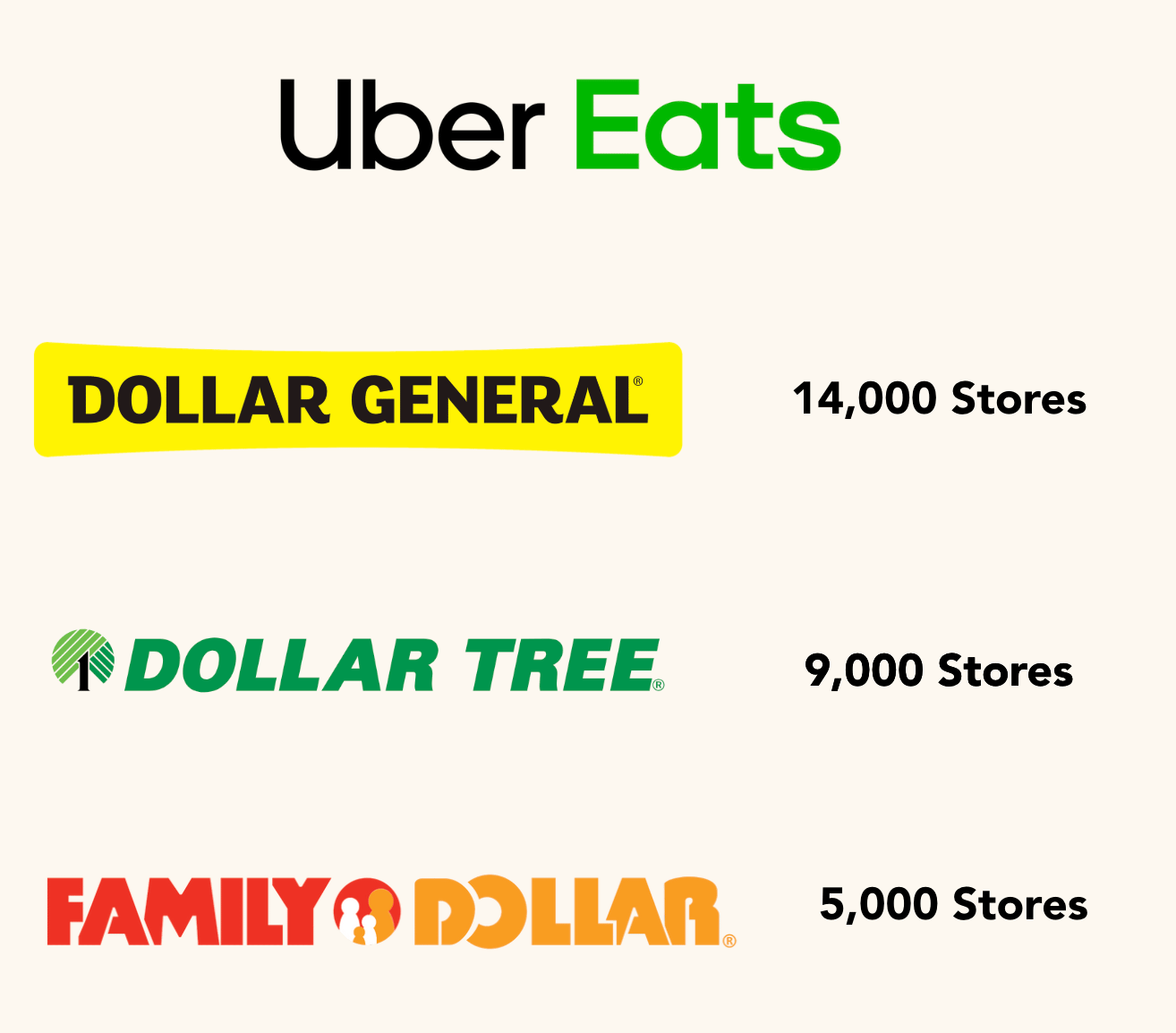

Meanwhile, new partnerships are being forged to dominate small-town America. Dollar retailers — Dollar General, Family Dollar, and Dollar Tree — now aim to evolve beyond being the closest store on the highway. By teaming up with Uber Eats, they are turning thousands of their stores into on-demand delivery hubs.

Dollar General has already rolled out Uber Eats at more than 14,000 locations. Family Dollar is live in 5,000+ stores, and Dollar Tree has added nearly 9,000 outlets to the app. And the benefit is mutual for all parties involved.

For example, Dollar stores can now scale online delivery without capital. By plugging into Uber’s platform, they instantly extend their reach to millions of app users without building new stores or investing in their own delivery fleets. Their small-box stores, scattered across rural and suburban landscapes, are suddenly transformed into last-mile hubs.

For Uber Eats, the partnership brings something just as valuable: consistency. Tapping into dollar stores’ 20,000+ locations gives Uber a reliable flow of orders — snacks, cleaning supplies, over-the-counter meds. It will also help Uber reach deeper into rural and small-town markets where there is more potential for growth.

Why are retailers rushing to rural America?

The retailers’ rush to rural America comes down to money and growth.

According to the USDA’s Rural America at a Glance 2023, the non-metro population is growing again after a decade of decline. Between July 2020 and June 2022, rural America added about 0.25% in net population, reversing years of stagnation. In 2020–21 alone, net domestic migration added 0.43% to rural populations.

The report states that across 58 million non-metro households, median household income now runs 15% higher than the national average. Combined with lower living costs, this means rural households have more discretionary dollars to spend. For retailers, that’s critical: it’s not just more people in the countryside, it’s people with more money left over after essentials.

It is also worth noting that advancements in logistics technology – including smarter routing, AI-driven fulfillment, and deployment of robots – have made servicing these geographical regions much easier and cost-effective.

Final Words

Once overlooked and underserved, rural America is now at the center of U.S. retail. It’s not just a race between the big players — the future growth, and even survival, of many chains will depend on how well they compete in the heartland.

This newsletter was written by Shyam Gowtham

Thank you for reading. We’ll see you at the next edition!