American retail today is more like the Wild West. One quarter, you’re leading the pack. And in a blink, you’re losing foot traffic, witnessing falling sales, and cutting forecasts. No brand is safe. No strategy is bulletproof. And the latest target in this high-stakes showdown? It is Target itself.

When the big box retailer announced its quarterly earnings on May 21, it painted a bleak picture. In Q1 2025, net sales dropped nearly 3% compared to the same period last year, and both revenue and earnings fell short of Wall Street’s expectations. The company also cut its full-year forecast, signaling more pain ahead.

So what happened to one of America’s favorite retailers? How did it go from being a public favorite to the brink of being mass-boycotted?

In this issue of CrossDock, we break down what went wrong at Target — and the strategy shifts, decisions, and circumstances that contributed to its sluggish performance. We’ll also bring to you how other major retailers have performed this quarter.

The Target Experience

In its six-decade journey, Target has grown from a regional discount chain into one of America’s most beloved retailers. And it has also already carved out a unique space in American retail. It's not just another big-box store. For many shoppers, Target is a brand with a personality.

Shoppers came for the convenience, but stayed for the experience. The stores felt cleaner. The products looked better. And the prices didn’t break the bank. Target mastered the art of blending style and affordability, offering everything from groceries and electronics to trendy home goods and clothing, all under one roof.

What really set Target apart, though, was the way it made people feel. With its bright aisles, curated displays, and that unmistakable red bullseye, a trip to Target became something more than just a run for toothpaste or paper towels. It was a small escape, a bit of everyday therapy, and people dearly called it the tar-zhay experience. The brand’s slogan, “Expect More. Pay Less,” wasn’t just marketing. For many, it was a promise Target consistently delivered.

But Target’s true purple patch arrived when a virus ravaged the world.

Purple Patch

The COVID-19 pandemic turned everyday life upside down. In 2020 and 2021, as much of the world stayed indoors, it changed the way people shopped. They were spending more and were stocking up on things, and they were not just essentials.

For many businesses, it was a time of disruption and deep uncertainty. But for Target, it was a period of remarkable growth.

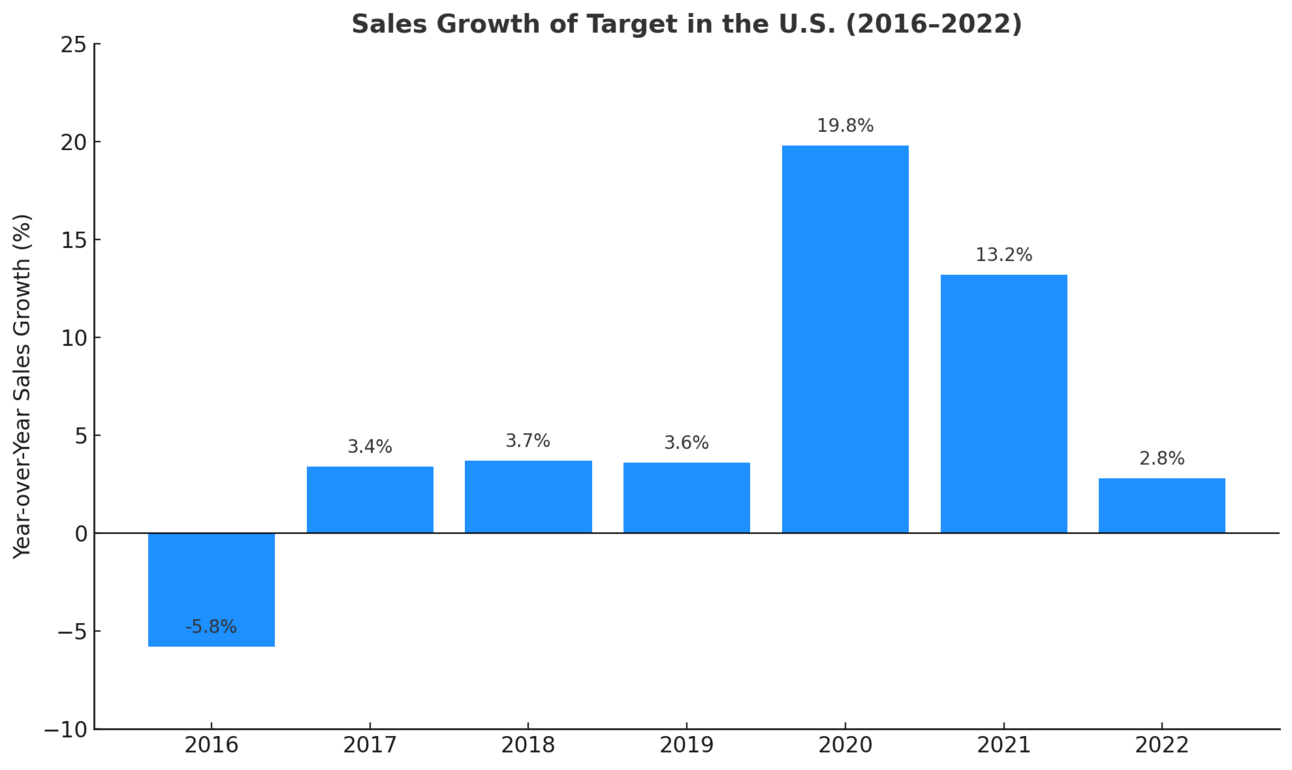

In 2020, Target experienced a substantial increase in revenue, reaching $93.6 billion, up from $78.1 billion in 2019. This 19.8% growth was driven by a 19.3% rise in comparable sales, with digital sales contributing significantly, growing by 118%, according to the 2020 Target Annual Report.

Operating income increased by 40.4% to $6.5 billion, and net earnings rose by 33.6% to $4.4 billion. And what was fueling this stellar performance? According to experts, this surge originated from changes in consumer behavior.

People were spending more on groceries, home goods, electronics, and everyday essentials — all categories where Target already had a firm footing. The company became a reliable one-stop shop, especially during lockdowns when convenience mattered more than ever.

This was also the time Target upped its online game. By building out same-day services like curbside pickup, local delivery through Shipt, and online fulfillment through its store network, it also met the huge online demand.

Building on this momentum, Target's total revenue grew to $106 billion in 2021, representing a 13.3% increase from the previous year. Comparable sales grew by 12.7%, with digital sales increasing by 20.8%. And in November 2021, the Target stock price shot up to an all-time high of $240.59.

At this point, Target had everything: a loyal customer base that was expanding each year, a brand that masses loved, a business that continued to grow year after year, and Target's stock was soaring.

Sadly, every rise has a fall.

By 2024, the red-hot streak had started to cool. Target still posted record top-line revenue — $106.6 billion for the full year — but the growth was diminishing. While sales were flat compared to 2021 levels, the company’s profits told a different story. Operating income declined to $5.57 billion, a sharp decrease from the $8.95 billion recorded in 2021. Net earnings also slid to $4.09 billion, reflecting the growing pressure on margins and rising operating costs.

Then came 2025, and the cracks widened.

In Q1 2025, reported on May 21, Target’s net sales fell nearly 3% year-over-year. The numbers missed Wall Street’s expectations across the board — revenue, earnings, and traffic were all down. Even in-store footfall was sluggish. The company responded by slashing its full-year guidance, signaling that it didn’t expect a quick rebound.

What’s worse, between 2021 and 2024, Target was the only one among the top four U.S. retailers to lose market share. Its share of core retail spending dropped by 0.18 percentage points — from 2.29% to 2.11% — according to an analysis by GlobalData.

So, what went wrong for one of America’s most beloved retail brands, and what caused its fortunes to turn so quickly? Let’s break it down for you.

Change of Times

During the pandemic, American households received stimulus checks to spend, were confined by lockdowns, and sought ways to make their homes more comfortable.

That combination led to a historic surge in spending, not just on groceries and toilet paper, but on non-essentials like throw pillows, blenders, loungewear, and backyard fire pits. Discretionary shopping became a form of therapy, and Target was perfectly positioned to serve it.

But once the world reopened and the checks stopped coming, a new reality set in. Inflation soared, reaching 8% in 2022 and remaining stubbornly high at over 4% through much of 2023. As costs rose across the board, consumers began tightening their wallets. That meant cutting back on non-essentials. Discretionary categories like home décor, apparel, and electronics, which are Target’s core strength, were suddenly out of favor.

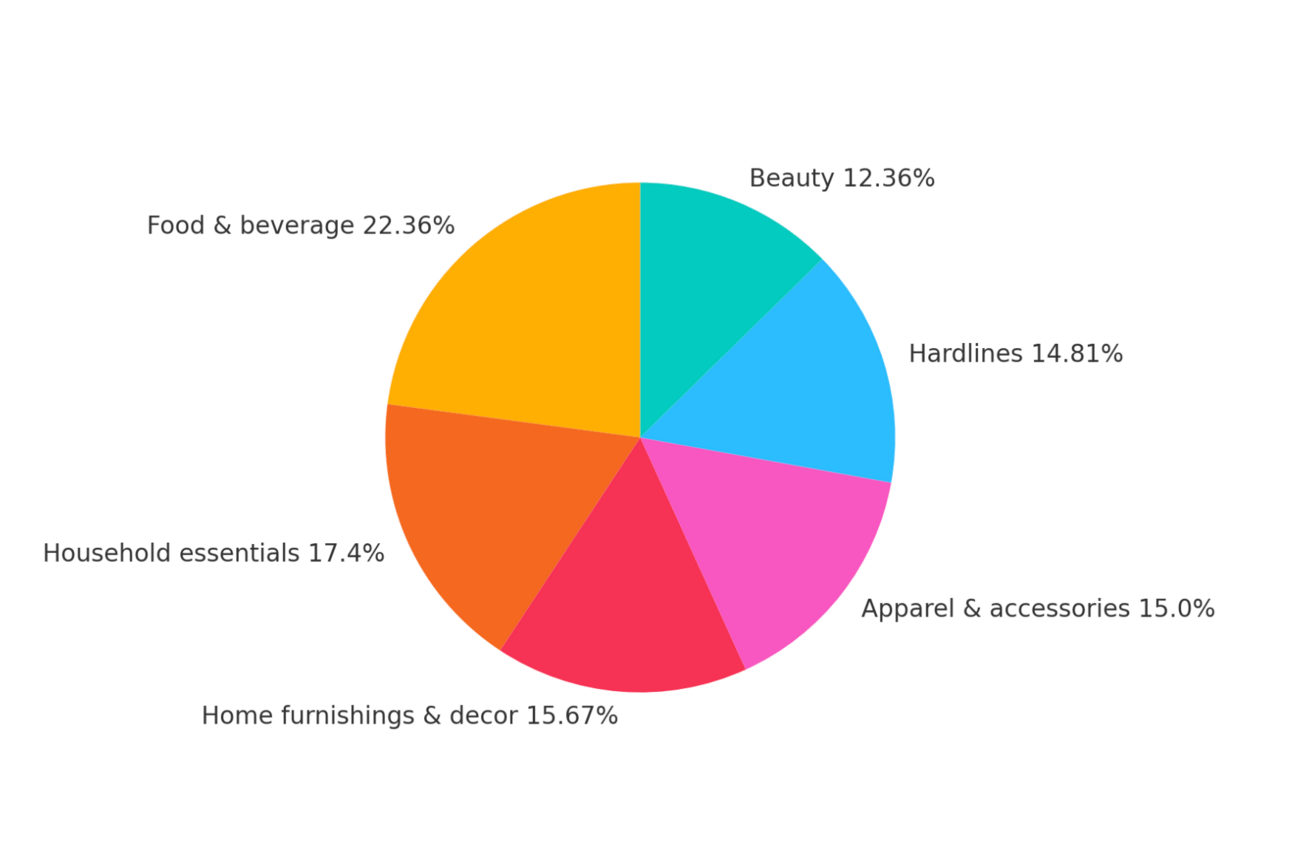

Target Sales Share by Product Category 2024

Unlike Walmart or Costco, which lean more heavily into groceries and everyday essentials, nearly 58% of Target’s sales come from discretionary merchandise. In other words, when shoppers pulled back, it hit Target harder than most, because it was stuck with inventory that the majority of shoppers no longer preferred.

And to clear unsold and excessive inventory, the company had to offer aggressive markdowns and clearance sales. Additionally, promotional deals were used to attract shoppers back.

But those deep discounts came at a cost. The heavy markdowns and promotional pricing significantly eroded Target’s margins, putting sustained pressure on its overall profitability. In the first quarter of 2025, Target's gross margin rate declined to 28.2%, down from 28.8% in the same period of 2024.

Yes, shoppers have changed. But so has Target, and not in ways they liked.

Chaos in Counters

Target stood out and, in fact, was loved for its bright lighting, curated displays, and neatly arranged shelves. In short, it made shopping feel less like a chore and more like a treat. But according to customers, in recent years, that signature “Tar-zhay” charm has started to fade.

Shoppers are increasingly complaining about messy aisles, disorganized merchandise, and empty shelves. In many stores, even basic items are frequently out of stock or locked behind glass, requiring employee assistance just to grab a bottle of shampoo or a pack of batteries. What was once a seamless, discovery-driven shopping experience now often feels frustrating.

Representational Image

But why is Target locking up products? The reason is a rise in in-store thefts.

In 2023, Target stated that it lost half a billion dollars to retail theft, a whopping 120% increase from the previous year. To prevent further damage, at some of its most affected locations, Target began locking up everyday essentials like soap, shampoo, razors, sometimes even socks and underwear

“We don’t like locking up products,” CEO Brian Cornell stated in an interview, “but we’re focused on keeping our stores open and ensuring they remain safe for both shoppers and staff.”

Another issue that’s affecting customers is the staffing shortages at Target. Many stores have shifted heavily toward self-checkout, but the move has backfired. Long lines, system glitches, and limited employee assistance have left customers increasingly frustrated.

For example, in 2024, the company introduced a policy limiting self-checkout to 10 items or fewer across nearly 2,000 locations. That move, combined with fewer staffed lanes and reduced in-store personnel, has led to long lines and growing shopper frustration.

When it rains, it pours — and that seems to sum up Target’s recent streak of misfortunes. A big blow to its popularity and business came after it rolled back its diversity, equity, and inclusion (DEI) policies.

Why are shoppers boycotting Target?

For years, Target built its brand on inclusivity — not just in marketing, but in merchandise, partnerships, and hiring. It celebrated Pride Month, stocked shelves with Black-owned brands, and frequently topped corporate diversity, equity, and inclusion (DEI) rankings.

But in January 2025, that began to change. The company quietly rolled back key diversity, equity, and inclusion (DEI) initiatives: ending external diversity surveys, rebranding supplier diversity programs, and discontinuing its $2 billion REACH commitment.

The backlash was swift. Loyal shoppers — especially younger, more progressive customers who once saw themselves in Target’s aisles and ads — felt blindsided.

Civil rights leaders condemned the move. TikTok videos calling for boycotts gained traction. And most visibly, a 40-day boycott led by Pastor Jamal Bryant reportedly resulted in a $12.4 billion loss in market value.

CEO Brian Cornell acknowledged the controversy during the Q1 2025 earnings call, citing the DEI pullback as one reason for the decline in foot traffic and weak consumer sentiment.

Immediately after the DEI rollback announcement in February 2025, foot traffic dropped 9% year-over-year, marking the steepest decline during this period, according to Placer.ai data. Between Q1 2024 and Q1 2025, visits to Target stores fell by 4.1%. While some of that drop reflects broader economic pressures, many former loyalists point directly to the DEI rollback as the reason they stopped showing up.

Another perennial problem that has been troubling Target for a very long time is inventory forecasting. In fact, experts say Target struggles to have the right inventory at the right time, which also contributes to its lacklustre performance.

It was evident in 2024, when Target anticipated a strike at East and Gulf Coast ports, rerouted shipments to West Coast ports, and adjusted shipment timings to ensure stock availability for the holiday season. However, this strategy led to elevated inventory levels earlier than usual.

But the longshoremen's strike just lasted two days. Target COO Michael Fiddelke acknowledged during the Q3 2024 earnings call that the decision to pull forward inventory helped ensure product availability, but it “came at a cost.” The move led to a 3% year-over-year increase in inventory, adding pressure through higher storage and logistics expenses.

What is Target Planning?

In March 2025, Target unveiled a long-term strategy aimed at generating over $15 billion in additional sales by 2030. A key part of the plan is expanding its private label portfolio, including a refreshed Good & Gather line with new chef collaborations and over 600 new food and beverage products from Good & Gather and Favorite Day

Target will continue to build on successful partnerships by expanding shop-in-shop formats with brands like Disney and Champion. It also announced a new collaboration with Warby Parker. Starting in the second half of 2025, Target will open five Warby Parker shop-in-shops at select locations that do not currently have Target Optical centers.

The most ambitious move in Target’s comeback playbook is its strategic push into small-town America. After years of expanding into urban markets, the retailer is now planning to open locations in underserved rural and suburban areas — places where residents have waited decades for a Target. These new stores, often exceeding 100,000 square feet, are designed not only for shopping but also to serve as fulfillment hubs, enabling the company to enhance last-mile delivery and digital order efficiency.

So, how did the rest of the retailers perform in the previous quarter?

Competitor Analysis

Let’s start with Walmart, which entered Q1 2025 with clear momentum, standing in sharp contrast to Target’s struggles.

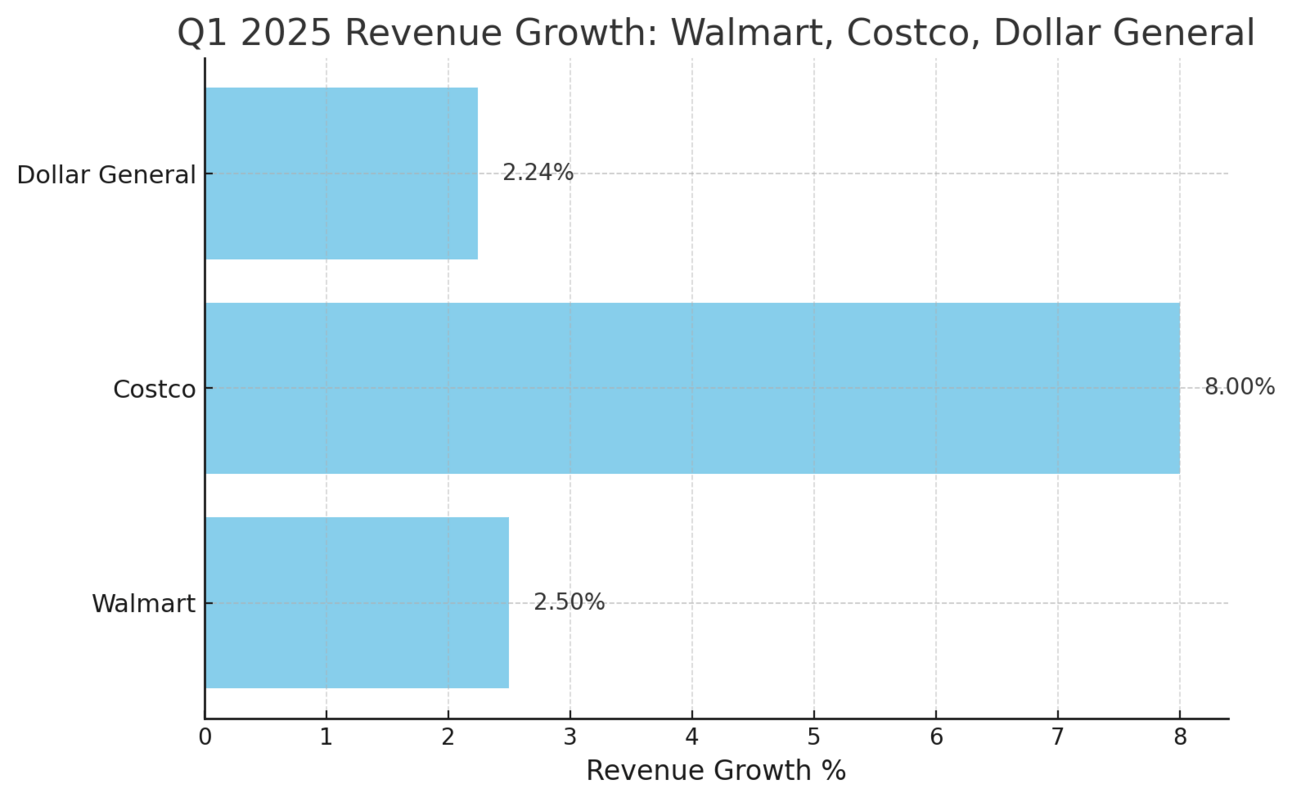

Walmart delivered strong Q1 2025 results, driven by strong demand in grocery, health & wellness, and seasonal categories. U.S. comparable sales were up 4.5%, and global e-commerce sales surged 22%, underscoring Walmart’s strength in blending store presence with digital fulfillment. Store-fulfilled pickup and delivery played a major role, reinforcing its omnichannel edge.

Costco was another success story. The wholesale club reported a 7.5% year-over-year increase in net sales, reaching $60.99 billion. Comparable U.S. sales rose 5.2%, while e-commerce grew by 13%, reflecting strong consumer appetite for value in bulk buying.

These performances indicate a broader retail shift: customers across various income levels are increasingly opting for value-focused shopping amid ongoing economic uncertainty. This was evident when Dollar General announced its earnings report. The discount chain saw a 5.3% increase in net sales to $10.4 billion, with same-store sales up 2.4%. What stood out most was the significant rise in higher-income shoppers seeking value, marking the highest percentage of such customers in four years.

Final Words

In a retail landscape shaped by rising tariffs, supply chain pressures, and shifting consumer habits, Target is at a crossroads. At a time when many shoppers are gravitating toward value and reliability, the company must work harder to reclaim its place in their routines.

On its latest earnings call, Target revealed a telling statistic: it gained or held market share in only 15 of the 35 merchandise categories it tracks. “We’re not happy with that,” CEO Brian Cornell admitted. “We’ve got to be growing [market] share in 60, 70, 80% of those categories.”

To that end, Target is launching a turnaround effort led by Chief Operating Officer Michael Fiddelke. The new Enterprise Acceleration Office will focus on simplifying operations, adopting smarter tech, and finding faster paths to growth.

It’s a step in the right direction—but the road ahead will require both discipline and reinvention.

This newsletter was written by Shyam Gowtham

Thank you for reading. We’ll see you at the next edition!