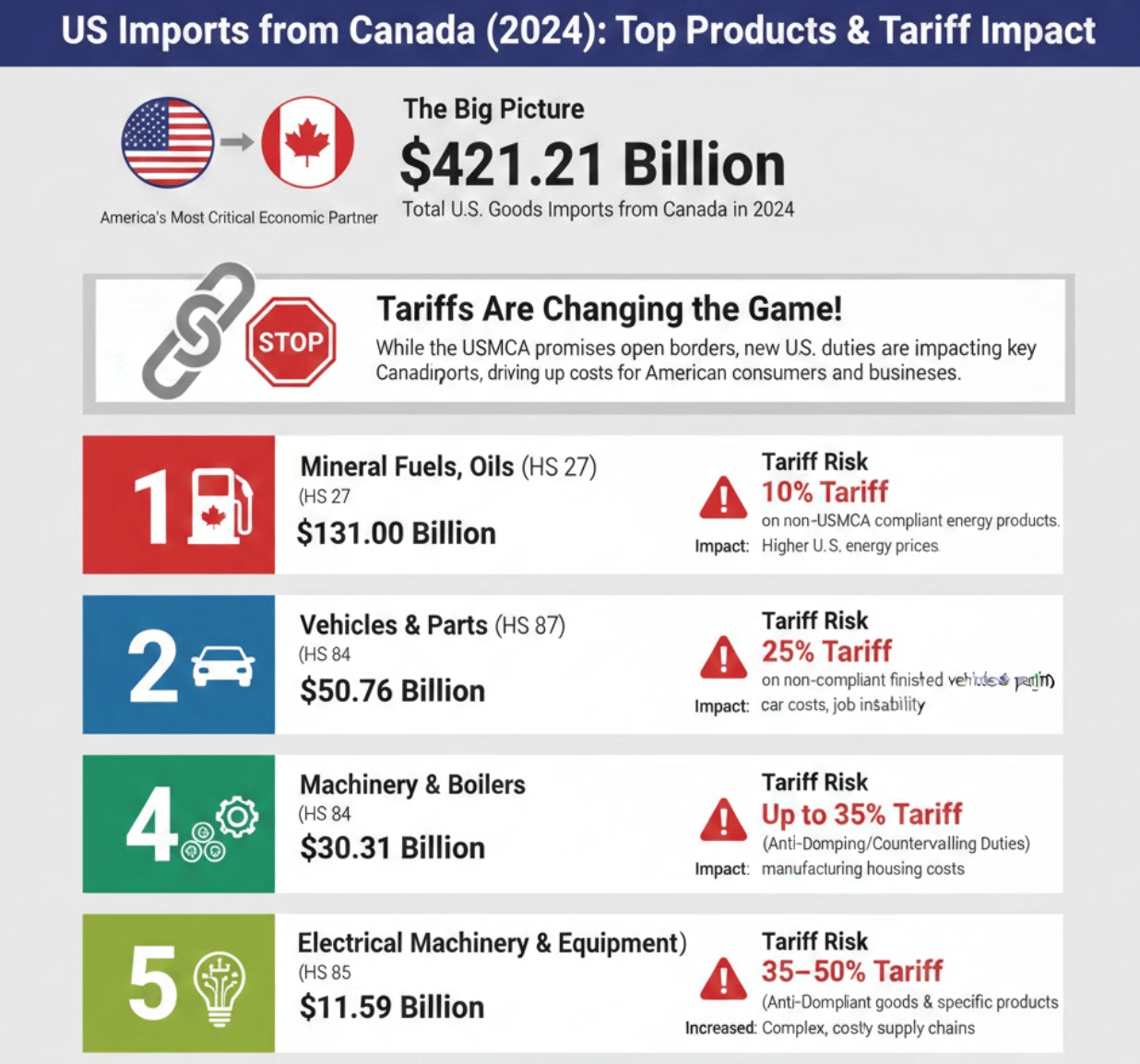

The economic bond between the United States and Canada is one of the world's most critical partnerships. U.S. goods imports from Canada totaled approximately $411.9 billion in 2024, showcasing trade flows that are essential to U.S. industrial strength.

While the USMCA promises tariff-free trade, this ideal is currently being disrupted. New, targeted U.S. duties are now being levied on key Canadian imports, directly increasing costs for American consumers and businesses.

Here are the top products the U.S. imports from Canada, detailing both their massive trade value and the specific tariff risk they face.

1. Mineral Fuels, Including Oil (HS 27)

Mineral fuels, primarily crude petroleum and natural gas, are the largest imports from Canada, underscoring its role as the backbone of U.S. energy security. This category alone is valued at an estimated $131 billion in 2024, with Canada supplying nearly two-thirds of all U.S. crude oil imports.

While most of this oil and gas is intended to be tariff-free, recent policy changes have introduced a 10% tariff on Canadian energy products deemed non-compliant with USMCA rules. This non-USMCA duty hits a significant portion of this massive import value, driving up the cost of refining and potentially translating to higher energy prices for U.S. consumers, highlighting the direct link between trade policy and domestic costs in sectors like energy.

2. Vehicles and Parts (HS 87)

The automotive sector is the second most valuable import, emphasizing the deeply integrated nature of North American manufacturing. U.S. imports of passenger cars, light trucks, and automotive parts from Canada are estimated to be between $51 billion and $56 billion.

This sector is highly sensitive to trade disputes, as a 25% tariff has been implemented on finished vehicles and parts that do not meet the strict rules of origin and regional content value requirements outlined in the USMCA. Industry leaders have warned that this high duty—even if only applied to the non-U.S. content portion of compliant vehicles—can add thousands of dollars to the final cost of cars, threatening job losses in both the Canadian and American auto parts manufacturing sectors and adding significant instability to a shared North American supply chain.

3. Wood and Softwood Lumber (HS 44)

While ranking lower in total dollar value, softwood lumber represents the single most contested commodity in U.S.-Canada trade, severely impacting the U.S. housing market. Imports in this category, valued at approximately $11.5 billion, have been subject to decades of ongoing U.S. anti-dumping and countervailing duties.

The current combined tariff on Canadian softwood lumber is estimated to be around a staggering 45% on the product's price. This massive tariff acts as a direct tax on U.S. homebuilders and consumers, with groups like the National Association of Home Builders (NAHB) estimating that such duties add thousands of dollars to the cost of a new single-family home, contributing directly to the current U.S. housing affordability crisis.

4. Industrial Machinery and Equipment (HS 84)

The import of industrial and specialized machinery, valued between $30 billion and $32 billion, is critical for U.S. factories and construction sites. This sector, while generally tariff-free under USMCA, faces risk due to its reliance on raw materials like steel and aluminum, and the broader threat of non-USMCA duties.

Specifically, a general 25% tariff can be applied to any machinery whose production chain fails to meet the strict USMCA rules of origin.

5. Electrical Machinery and Components (HS 85)

Imports of electrical machinery and components, estimated at $10 billion to $11.2 billion, support electronics, power grids, and manufacturing across the U.S. While the majority of this trade is conducted without duty, a growing concern is the imposition of tariffs aimed at penalizing the transshipment of goods.

The U.S. has targeted finished wood products (which often contain electrical components, such as cabinets and vanities) with a 25% tariff—a duty that can potentially increase to 50%. This action not only raises the cost of these specific finished goods but also increases the risk of higher duties being applied across the board for any component suspected of being rerouted through Canada to avoid other country-specific tariffs.

The Road Ahead

The current wave of U.S. tariffs, despite the existence of the USMCA, signals a fundamental shift toward greater trade protectionism. This has forced both American importers and Canadian exporters to overhaul their risk management strategies and supply chains.

The economic and diplomatic tensions generated by these new duties will undoubtedly dominate the upcoming USMCA Review, scheduled to begin in July 2026. This mandatory review, which occurs every six years, will assess the agreement's performance and determine whether to extend its term for another 16 years.

Failure to agree on an extension could risk the agreement's termination by 2036. The issues currently defined by tariffs—including regional content rules for autos, steel, and aluminum, and the fate of energy exports—will form the core of highly contentious negotiations. For businesses, the 2026 review is not just a regulatory event; it is a critical node that will determine the stability and predictability of the entire North American manufacturing and trade environment for the next decade.

❓ Frequently Asked Questions (FAQs)

1. Who pays the U.S. tariff on Canadian goods?

The U.S. importer. While the U.S. government levies the tariff on the Canadian-origin product, the Importer of Record (IOR)—the U.S.-based individual or company bringing the goods into the U.S.—is legally responsible for paying the tariff to U.S. Customs and Border Protection (CBP). These costs are then typically passed along the supply chain to end-users and consumers.

2. Is all Canadian trade now subject to tariffs?

No, the vast majority is still tariff-free. The USMCA continues to govern the majority of the trade relationship, meaning Canadian exports that meet the agreement's specific Rules of Origin are generally exempt from these new duties. The tariffs discussed are primarily aimed at products deemed non-compliant with USMCA rules or are sector-specific duties (like those on lumber) imposed for other reasons.

3. What is the highest tariff rate currently hitting a major Canadian import?

The highest active tariffs are the Anti-Dumping and Countervailing Duties (AD/CVD) on Canadian Softwood Lumber, which have recently been set at a combined rate of up to 35%. This directly impacts the U.S. construction and housing sectors.

4. Why are the new U.S. tariffs being imposed on its closest ally?

The stated rationale for the new tariffs is primarily to reduce the U.S. trade deficit, encourage domestic manufacturing ("reshoring" production), and pressure Canada on non-trade issues like border security. In short, the U.S. is using tariffs as a tool to gain leverage and push for greater manufacturing self-sufficiency in key strategic sectors.

5. What is the USMCA Review in 2026?

The USMCA Review is a mandatory, high-stakes reassessment of the trade agreement set to begin in July 2026. Representatives from the U.S., Canada, and Mexico must meet to assess the deal's operation and decide whether to extend the agreement for another 16-year term. The current tariff disputes are expected to make this review a turbulent period of negotiation.